Technology has the power to democratize access to financial services. It allows for the creation of inclusive financial ecosystems that cater to all, regardless of their socioeconomic status or geographic location. Here’s how technology is making a difference:

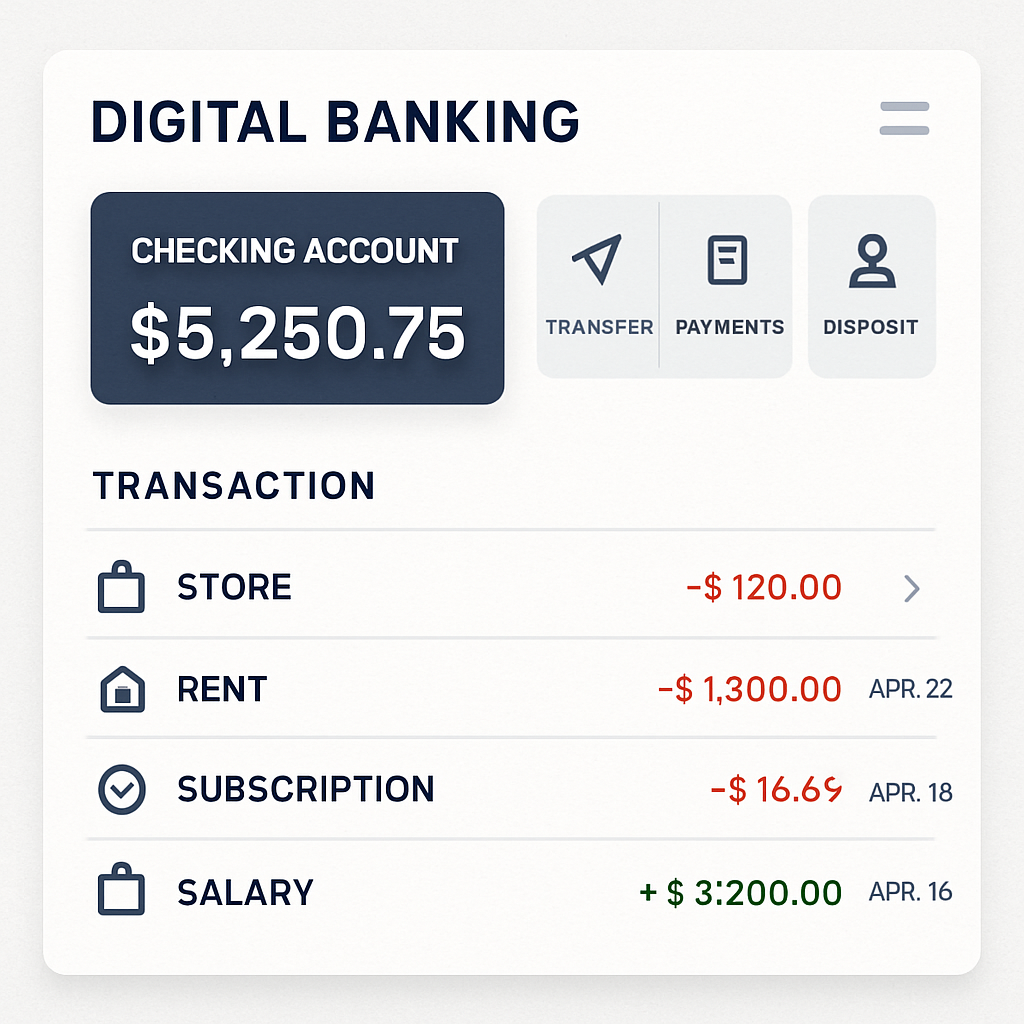

Digital Banking

Digital banking platforms have revolutionized how people access and manage their finances. They provide a convenient and cost-effective alternative to traditional banking. With a smartphone and internet access, individuals can open bank accounts, transfer money, pay bills, and much more without visiting a physical branch.

Digital banking is particularly beneficial for those in remote areas where access to brick-and-mortar banks is limited or non-existent. It eliminates the barriers of distance and time, making financial services accessible to everyone. The user-friendly interfaces of digital banking apps also encourage more people to manage their finances actively, promoting financial responsibility.

Moreover, digital banking enhances transparency and security in financial transactions. By using digital platforms, users can easily track their spending and savings, which helps them make informed financial decisions. The integration of biometric authentication and encryption further ensures that digital banking remains secure and trustworthy.

Mobile Money

Mobile money services have gained popularity, especially in developing countries. These services allow users to store and transfer money using their mobile phones. It’s a simple and effective solution for those without access to formal banking services.

Mobile money has proven to be a game-changer in promoting financial inclusion. It provides a safe and secure way for people to conduct transactions and save money. Additionally, mobile money facilitates peer-to-peer lending and microfinance, offering financial opportunities to individuals who might otherwise be excluded from traditional financial systems.

Moreover, mobile money has empowered small businesses by enabling them to accept digital payments, thus expanding their customer base. This shift not only boosts local economies but also encourages entrepreneurship, as business owners have greater access to financial resources and can operate more efficiently.

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies are emerging as potential game-changers in financial inclusion. Blockchain provides a decentralized and secure way to conduct transactions, which can be especially beneficial in regions with unstable financial systems.

Cryptocurrencies offer an alternative to traditional currencies and can be used for cross-border transactions without the need for intermediaries. This can lower transaction costs and increase the speed of money transfers, making it easier for people in developing countries to receive remittances from abroad.

Furthermore, blockchain-based solutions can help in creating digital identities for the unbanked, enabling them to access financial services that require identity verification. This innovation could significantly reduce the barriers to financial inclusion and create a more equitable financial ecosystem.

Financial Literacy: A Key Component

While technology provides the tools for financial inclusion, financial literacy ensures that individuals can use these tools effectively. Understanding basic financial concepts is crucial for making informed decisions and managing personal finances.

The Importance of Financial Education

Financial literacy programs equip individuals with the knowledge and skills necessary to navigate the financial ecosystem. These programs cover essential topics such as budgeting, saving, investing, and understanding credit. By improving financial literacy, we empower people to make better financial decisions and avoid pitfalls such as debt and fraud.

In addition, financial education helps individuals understand the value of saving and investing for the future. This knowledge is crucial for building wealth and achieving financial stability. Financial literacy also encourages individuals to plan for unforeseen circumstances, such as medical emergencies, by promoting the importance of insurance and emergency funds.

Furthermore, financial education can lead to greater economic stability within communities. As more individuals become financially literate, they contribute to a more robust and resilient economy, as they are better equipped to manage their finances and invest in local businesses.

Integrating Financial Literacy with Technology

Technology can also play a role in delivering financial education. Online courses, mobile apps, and interactive tools can provide accessible and engaging learning experiences. These resources can be tailored to different audiences, ensuring that everyone, regardless of their education level, can benefit.

For instance, gamified learning platforms can make financial education more engaging, especially for younger audiences. By simulating real-life financial scenarios, these tools can teach users how to manage their finances in a risk-free environment.

Moreover, leveraging social media and online communities can help spread financial literacy more broadly. Platforms like YouTube and Instagram can be used to share educational content in a format that is easy to understand and widely accessible. This approach can reach diverse audiences and encourage more people to take an active interest in their financial well-being.

Overcoming Barriers to Financial Education

Despite the availability of resources, there are still barriers to financial education that need to be addressed. Language barriers, cultural differences, and varying levels of access to technology can hinder the effectiveness of financial literacy programs.

To overcome these challenges, educational content must be localized and culturally sensitive. By collaborating with local organizations and community leaders, financial education initiatives can be tailored to meet the specific needs of different populations. Additionally, ensuring that educational resources are available in multiple languages can help reach a broader audience and promote inclusivity.

Building Technology-Driven Ecosystems

To achieve true financial inclusion, we need to build comprehensive ecosystems that integrate technology, financial services, and education.

Partnerships and Collaborations

Collaboration between governments, financial institutions, tech companies, and non-profits is essential. By working together, these entities can create robust ecosystems that address the needs of underserved populations. Governments can provide regulatory support, while tech companies and financial institutions can develop innovative solutions.

Public-private partnerships can drive innovation by combining resources and expertise from different sectors. These collaborations can lead to the development of new financial products that cater to the unique needs of the unbanked and underbanked. Additionally, partnerships with educational institutions can enhance financial literacy efforts, ensuring that individuals are equipped to use digital financial services effectively.

Furthermore, fostering a culture of collaboration can lead to the sharing of best practices and successful models across regions and sectors. This exchange of knowledge can accelerate the development and implementation of effective financial inclusion strategies.

Infrastructure Development

Investing in digital infrastructure is crucial for the success of technology-driven ecosystems. This includes expanding internet access, improving mobile network coverage, and ensuring data security. With the right infrastructure in place, more people can access digital financial services.

Developing infrastructure in rural and underserved areas can significantly impact financial inclusion. By providing reliable internet and mobile connectivity, individuals in these regions can access digital banking and financial education resources, opening up new opportunities for economic participation.

Moreover, infrastructure development should prioritize security and privacy to build trust in digital financial services. Implementing robust cybersecurity measures and data protection regulations can protect users’ information and encourage more people to adopt digital financial solutions.

Tailored Financial Products

Financial products should be designed with the needs of the unbanked and underbanked in mind. This includes offering low-cost accounts, micro-loans, and insurance products that cater to the unique challenges faced by these populations. Tailored products can help bring more people into the formal financial system.

Developing financial products that are culturally relevant and accessible can increase adoption rates among underserved populations. For example, providing micro-loans with flexible repayment terms can support small business owners and entrepreneurs in growing their ventures.

Additionally, creating financial products that integrate with existing community practices can enhance their acceptance and use. By understanding the local context and collaborating with community leaders, financial institutions can develop products that resonate with the target audience and encourage wider participation in the formal financial system.

Overcoming Challenges

Despite the potential of technology-driven ecosystems, several challenges must be addressed to achieve financial inclusion.

Digital Divide

The digital divide remains a significant barrier. Many people still lack access to the internet or smartphones, which limits their ability to benefit from digital financial services. Efforts must be made to bridge this gap through affordable technology and improved connectivity.

Addressing the digital divide requires a multi-faceted approach. Governments and private sector partners can collaborate to subsidize the cost of technology and internet access for low-income households. Additionally, community-based initiatives can provide training and resources to help individuals develop digital skills and confidence in using technology.

Expanding network infrastructure in rural and underserved areas is also critical. By investing in broadband and mobile network development, more individuals can access the digital tools they need to participate in the financial ecosystem.

Trust and Security

Building trust in digital financial services is essential. Many individuals are wary of using digital platforms due to concerns about security and privacy. Financial institutions and tech companies must prioritize data protection and build systems that instill confidence among users.

Implementing transparent and robust security measures can help alleviate concerns about digital financial services. Regular audits and updates to security protocols can ensure that digital platforms remain secure and trustworthy. Educating users about safe online practices and the importance of safeguarding personal information can further enhance trust.

Moreover, fostering open communication with users can help build trust. By actively addressing user concerns and providing clear information about security measures, financial institutions can create a more reassuring environment for users to engage with digital financial services.

Cultural and Social Barriers

Cultural and social factors can also impact the adoption of digital financial services. Education and awareness campaigns can help address misconceptions and encourage more people to embrace digital solutions.

Understanding the cultural context is crucial for designing effective financial inclusion initiatives. By working with local communities and leaders, financial institutions can develop culturally relevant solutions that resonate with the target audience. Tailoring messaging and educational content to align with local values and beliefs can increase the likelihood of adoption.

Additionally, creating platforms that accommodate different languages and literacy levels can ensure that digital financial services are accessible to all. By promoting inclusivity and addressing cultural and social barriers, we can create a more welcoming environment for individuals to engage with digital financial tools.

The Future of Financial Inclusion

The future of financial inclusion is bright, thanks to technology-driven ecosystems. As digital banking and financial literacy continue to evolve, more people will gain access to the financial services they need to improve their lives. By addressing the challenges and building comprehensive ecosystems, we can create a world where everyone has the opportunity to participate in the formal economy.

In conclusion, technology is a powerful tool for promoting financial inclusion. By integrating digital banking, financial literacy, and tailored products into cohesive ecosystems, we can break down barriers and create a more inclusive financial landscape. The journey towards financial inclusion is ongoing, but with the right strategies and collaborations, we can achieve significant progress.

The continued innovation in financial technology promises to unlock new opportunities for inclusion. As we embrace emerging technologies such as artificial intelligence and machine learning, we can develop even more personalized and efficient financial solutions. These advancements have the potential to transform the financial landscape, making it more accessible and equitable for all.

Ultimately, achieving financial inclusion requires a collective effort from all stakeholders. By working together and leveraging the power of technology, we can create a future where financial services are available to everyone, regardless of their background or circumstances. The road ahead may be challenging, but the potential rewards are immense, as we strive to build a world where financial inclusion is a reality for all.