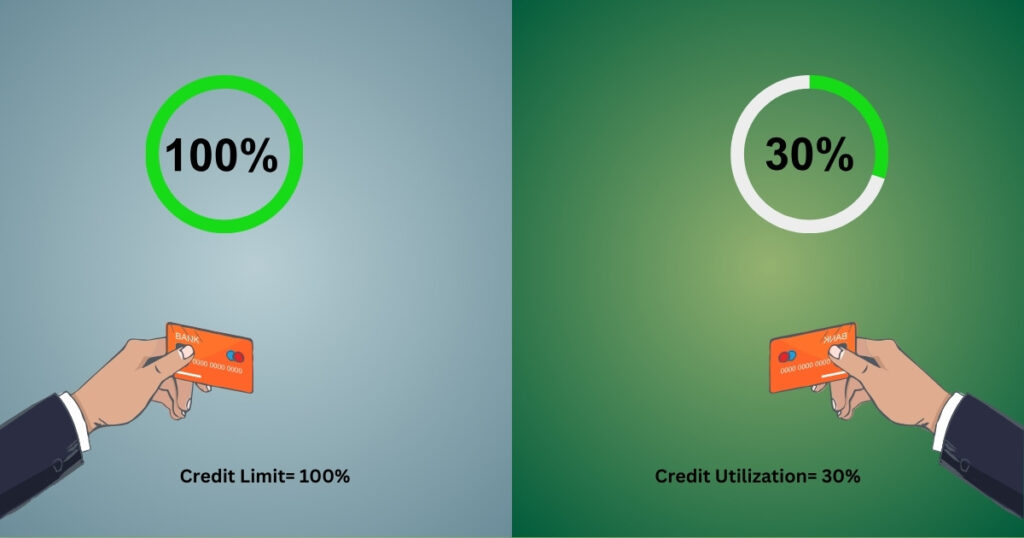

Your credit score is measured on various factors. Apart from timely loan payments, your credit utilization ratio is an important component of your credit score. The FICO score gives a 30% weightage to credit utilization. Ideally, one should keep the ratio below 30% to maximize credit score. A higher credit utilization leads to lower credit score.

Marinating a high credit score is imperative to obtain loan approval. Since credit utilization is a significant parameter of credit score, it is imperative to have a clear understanding of different aspects of credit utilization. The following section of the article would discuss credit utilization, how it impacts credit score and the essential steps to manage credit utilization to enhance credit score.

Credit Utilization Ratio

Credit utilization ratio refers to the ratio of the amount of money you have as debt to your credit limit. For instance, your credit card limit is $20,000. Utilizing up to 30% of the limit will indicate your credit utilization ratio is 30%, the recommended limit of the ratio by FICO. Utilizing 30% of $20,000 means you have borrowed only $6000. Utilizing more than 30% of your credit limit impacts your credit score negatively. A higher credit ration is indirectly proportional to your credit score. Thus, you must try to keep available credit up to 70%.

It is not always possible to maintain a fixed ratio. In emergency situations people need the ration to go up. However, you can work towards reducing credit utilization. The best way to manage your credit is to take professional help. You must seek help from qualified credit repair services in Sacramento, who can guide you in your credit repair journey.

DIY Method of Lowering Credit Utilization Ratio

In case you have exceeded your credit utilization limit you must try to lower it as soon as possible to enhance your credit score. Although seeking professional help is recommended, credit utilization ratio can also be managed without any help. Except for complex cases, DIY methods of reducing credit utilization ratio can save you from a low credit score. Here are some useful tips on how to lower credit utilization:

1. Request for an Increase in Credit Limit

Expanding the credit limit is an effective way to reduce credit utilization ratio. You must communicate with your credit card issuer to increase your credit card limit. For instance, if your income has increased from the time you have issued a credit card, updating your current income can boost your credit limit.

However, it is important to keep in mind that while you apply for an elevated credit card limit, you have no outstanding loan payment. Having outstanding loans can lower your utilization ratio even more. Alternatively, you can get a new credit card issued to obtain additional credit limits.

2. Clear your Balances

Paying off your outstanding debts is also an effective way to boost your credit utilization percentage. You can even pay biweekly to finish off your debt payment faster than once a month payment. In case you have a credit mix then getting rid of bigger loans first is a smarter way to enhance credit utilization.

3. Balance Reporting Day is Important

Your credit card issuer reports your balance to credit bureaus on a specific date. It is important to pay off your debt before that date. Your payment due date is often not the same as the date when your balance is reported. Suppose your due date is on the 13th of a given month and your credit card issuer reports your balance on 11th of that month. It is better to pay off your loan before the reporting date. Always ask your credit issuer about the credit reporting date to clear off your debt beforehand.

4. Use Multiple Cards

Using multiple cards simultaneously reduces the utilization rate of one card. If you are using three credit cards, try to spread your purchase across all the three cards. In case you make frequent transactions with your credit cards and make heavy purchases, maintaining multiple cards will boost your credit utilization ratio.

Bottom line

Credit utilization ratio is an important factor for your credit score. Keeping your credit utilization ratio below 30% is the ideal range. Higher credit utilization has a negative impact on your credit score. By following the above mentioned strategies you can easily repair your credit utilization rate and boost your credit score.